Panther Capital Group is a data-driven brokerage focused on Industrial Outdoor Storage.

Panther Capital Group is a data-driven brokerage specializing in Industrial Outdoor Storage (IOS) and industrial real estate across the U.S. With over $250 million in closed transactions and access to $5 billion+ in partner and investor capital, we leverage market intelligence and relationships to move deals faster, often securing offers in under 24 hours. Connect with an advisor today.

Founder & CEO

We partner with investors, property owners, and brokers across the country to close deals that others can’t access. Whether you’re buying, selling, or leasing our team is here to guide you with insight and experience.

We can guide you through acquiring, stabilizing, managing, and selling commercial and industrial assets.

Get real-time insights and strategic guidance to maximize the value of your property through leasing or sale.

We help you find the right industrial site, well-located, efficient, and aligned with your long-term growth.

We continuously gather real-time market data and leverage AI-driven tools to make faster, smarter decisions, giving our clients nationwide reach with hyper-local precision.

Backed by a network of active buyers with substantial capital ready to deploy quickly.

Industrial real estate is all we do. It’s what we know best.

We close deals across the U.S. through a trusted network.

We support investors, property owners, and operators with services designed to uncover opportunities, simplify transactions, and deliver long-term value.

We acquire and reposition high-quality industrial assets, partnering with investors to create long-term value.

We combine market data and relationships to match industrial owners with active, qualified buyers.

Explore flexible leasing options tailored to take your business to the next level.

We can help you complete due diligence, boost marketability, and make smarter investment decisions.

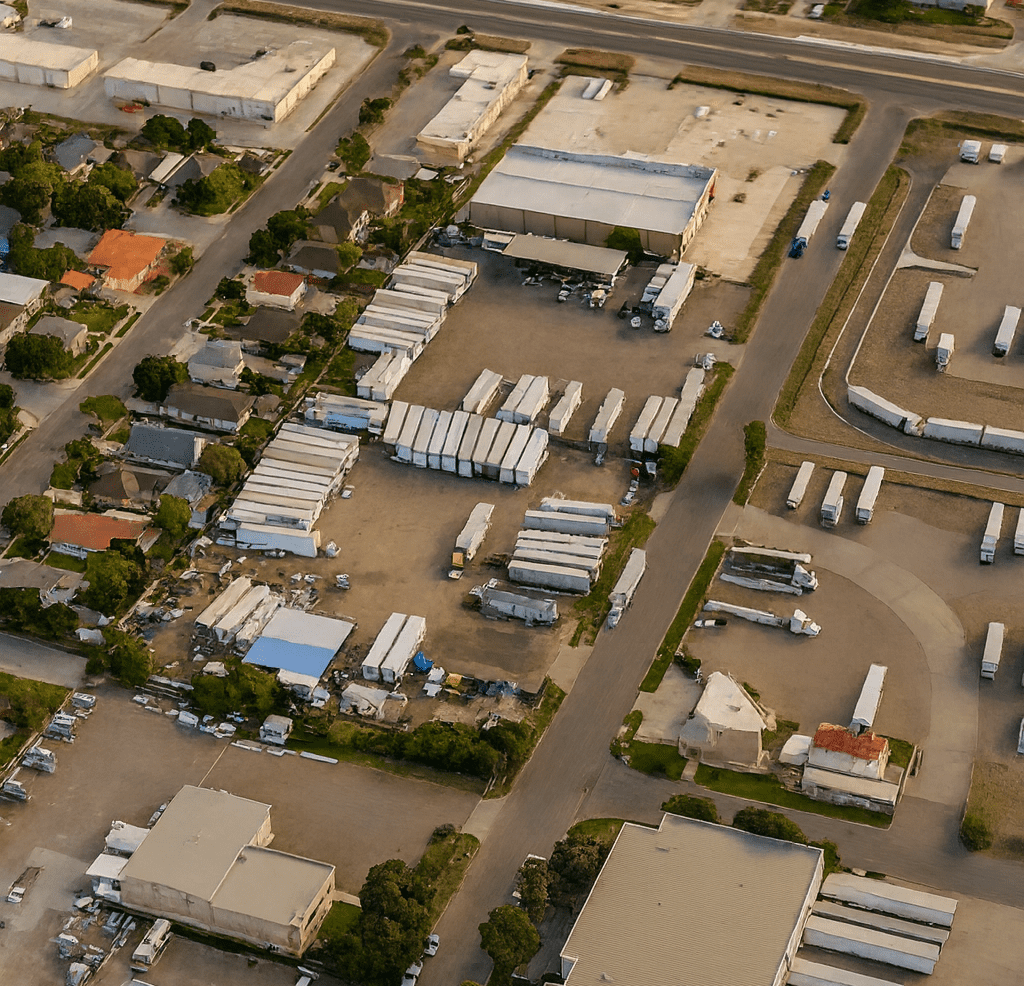

Industrial Outdoor Storage (IOS) refers to zoned commercial or industrial land used for storing trucks, trailers, containers, heavy equipment, pallets, construction materials and other large assets outdoors. IOS has become a major asset class as e-commerce and logistics demand continues to grow.

Demand is increasing due to the growth of e-commerce, last-mile delivery, port logistics and trucking operations. Companies need large outdoor sites for staging, parking and equipment storage, making IOS essential for modern supply chains.

Common IOS property types include:

• Truck parking lots

• Trailer and container yards

• Equipment storage lots

• Outdoor warehouses

• Cold-storage yards

• Car and food-truck parking lots

• Tank storage sites

• General outdoor storage facilities

IOS sites are typically used for:

• Truck terminals and fleet parking

• Trailer/container storage

• Construction equipment storage

• Pallet and material staging

• Vehicle parking for logistics and service companies

• Seasonal or overflow storage

When evaluating an IOS site for purchase or lease, focus on the following:

Core Site Features

• Wide drive aisles for truck circulation and maneuverability

• Grade-level drive-in access

• Fenced and secured perimeter

• Controlled access gates

• Stabilized surface such as asphalt, concrete, compacted gravel, stone, or millings

• Two points of ingress and egress for efficient truck flow

• Adequate lighting across the entire yard

• Security systems with cameras or on-site monitoring

Building Features (if applicable)

• Clear heights of 18 to 30 feet or higher

• Roll-up doors of 14 to 16 feet or higher

• Small to midsize warehouse space, usually 5,000 to 25,000 square feet

The best approach is to focus on logistics-heavy areas near highways, ports, rail corridors, and high-demand industrial zones. IOS opportunities include truck parking lots, trailer yards, and other stabilized outdoor facilities.

Many IOS sites are never publicly listed because supply is very limited. If you need help finding IOS space to lease or purchase, we can source on-market and off-market options that match your requirements. Contact us to begin your search.

IOS rental rates vary by market, zoning, lot size, yard stabilization, access, and security features. A few general guidelines:

• IOS is leased on a per-acre basis, not per square foot

• Typical rates range from 2,500 to 18,000 dollars per acre per month

• Markets near ports, highways, and dense logistics hubs command premium pricing

• Fully improved sites with pavement, fencing, lighting, and two access points lease at the higher end

• Raw or unstabilized yards tend to lease at the lower end

Because IOS supply is very limited, pricing can change quickly. If you need current IOS rental rates for your city or metro, we can prepare a customized report.

IOS has become one of the most attractive real estate investment categories for several reasons:

• High demand from logistics, transportation, construction, and service operators

• Limited supply because of restrictive zoning and few development opportunities

• Lower capital expenditures compared to traditional industrial buildings

• Strong yields in land-constrained markets

• Reliable long-term cash flow and tenant retention

These factors make IOS a compelling long-term investment for both private and institutional buyers.

IOS supports large-scale, outdoor operations, unlike self-storage, which focuses on small personal units. Warehouses store goods indoors and require enclosed infrastructure, while IOS provides flexible open-air space for equipment, vehicles and high-volume logistics.

"I worked with them on a land transaction in Polk County which we closed last May. It was a very difficult site, and they were instrumental in us getting the transaction closed. They also are able to uncover buyers who you normally would not see. I would highly recommend working with him and his team."

Edward Mitchell

President of Mitchell Property Reality Inc.

"Alterra has worked with Guillermo and the Panther team for several years now over a number of transactions. They are problem solvers and continue to assist on the transaction well beyond the initial sourcing. What I really value though is the long-term mindset and partnership mentality of Panther Capital Group."

Matt Pfeiffer

CIO Alterra Property Group

"Guillermo has been a trusted advisor of mine for several years now. With his guidance we have purchased several value add industrial assets that have aged well in our portfolio. He sourced the deals for us and was there each step of the way through the due diligence process and closing, working as a partner to help get the deal across the finish line."

Nick Jones

CEO Red Bell Partners

Whether you’re selling, investing, or searching for space, our team connects you with the right opportunities in the Industrial Outdoor Storage market.

Sign up to receive property alerts for the latest industrial and off‑market listings that match your investment goals. We work across 20+ states and specialize in finding high‑quality opportunities before they hit the public market.

Copyright © 2025 Panther Capital Group – All rights Reserved